Figure 1: Warren Buffet Quote.

One of my favorite investors, Warren Buffet, says, "if you don't find a way to make money while you sleep, you will work until you die.". Most people think that to get rich, you need progressively higher-paying jobs, but this is only half of the equation. More often than not, as you go up the corporate ladder, you get higher-paying jobs but also much more stress and have less time to devote to your investments.

Figure 2: Lounging on a beach.

Now, imagine lounging on the beach and still making money through passive sources of income! The good news is that there are a wide variety of sources for passive income.

Figure 3: The game Cashflow 101 by Rich Dad.

One way to generate passive income is by owning real estate so you can charge people rent. You can also receive stock dividends or royalties from books or songs you have produced. Additionally, you can own a business that is managed by someone else. An excellent game to play to learn about generating a passive income that I recommend is "Cashflow 101" by the Rich Dad Series. Remember, most millionaires on the average have seven streams of income that are mostly passive income-based. The great news is that there are many new and exciting ways to make passive income with cryptocurrencies. Using all my research, practical experience, and the occasional run-in with scams, here are the top 10 passive ways to earn income with cryptocurrencies that I discovered:

- Buying / Building a Mining Machine

- Invest in a Mining Farm

- Lease a Mining Share

- Own a Mining Farm

- Direct Dividend Coins

- Exchange Dividend Coins

- Staking

- Masternodes

- Hard Forks

- Trading Bots

Passive Method 1: Buying / Building a Mining Machine

A great way to make passive income with cryptocurrency is to buy or build a "money-making" mining machine. When you maintain a mining machine, you aid with the global proof of work network used by many popular cryptocurrencies such as Bitcoin. There are two types of ways to mine for cryptocurrency, either graphics processing unit (GPU) based or application-specific integrated circuit chip (ASIC) based. Figure 4 shows a basic 6 GPU Mining Rig, and figure 5 shows an ASIC based, AntMiner S9 Bitcoin Miner. GPU based mining is not as effective as ASIC based mining but is less expensive, consumes less power, and generates much less sound. Hence, GPU mining can be done at home or in your office. ASIC based miners have high performance but are more expensive, consume lots of power, and generate deafening sound. Therefore, ASIC based miners are better suited for warehouses or rooms with lots of soundproofing and sound blocking amenities that also allow for lots of power consumption.

Figure 4: A 6 GPU Mining Rig

Figure 5: AntMiner S9 Bitcoin Miner

Tip: A great website to purchase pre-built GPU mining rigs is www.mining.sg or cryptocurrencyminingrigs.info. For purchasing ASIC based miners, asicminermarket.com is a useful resource, but available units are frequently sold out!

Passive Method 2: Invest in a Mining Farm

Alternatively, for a passive income, you can invest in a cryptocurrency mining farm. You can spend money on an upcoming mining farm endeavor. Cryptocurrency mining farms typically are ASIC based because of the high return on investment (ROI) of ASIC based mining versus GPU based mining. Many are located in colder climates to lessen cooling costs. Mining farms typically mine the most established cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), etc.Tip: If you want to invest serious money into a mining farm endeavor, it might be worthwhile for you to visit the mining location in person first.

Passive Method 3: Lease a Mining Share

For people who are not technically inclined or don't have space or time to maintain a GPU based miner at home or in their office, leasing a mining share, also known as cloud-based mining, is a viable option. Again beware of many online scams and Ponzi schemes, especially concerning cloud-based mining. Double-check with http://www.badbitcoin.org/ if the site is a verified cloud-based mining operation. It is very convenient to lease a mining share temporarily. Typically, 1 to 2-year mining share contracts is available. Mining shares that give the best ROI are those that have minimal energy and cooling costs.Tip: Hashflare, Genesis Mining, and Minergate are dependable cloud-based mining services.

Passive Method 4: Own a Mining Farm

If you are technically inclined and have time and space to devote, then you might consider building your own home-based cryptocurrency mining farm instead. Home-based cryptocurrency mining farms are typically located in the garage or storage area and employ GPU based mining more often due to the lower cost involved, lower power usage, and less sound. However, ASIC based mining can be accomplished as well if the mining room has excellent sound-absorbing / proofing amenities and can support higher power consumption too.Tip: There are some ASIC based miners specifically built for home use such as the Antminer R4 model though the return on investment with these types of miners is typically less than their much louder counterparts!

Passive Method 5: Direct Dividend Coins

A dividend is a distribution of a portion of a company's earnings. Similar to traditional stock dividends, some cryptocurrency coins offer dividends too. You hold the crypto coin and get regular dividends, which vary for each cryptocurrency coin.Tip: Here are some examples of direct dividend coins: Neo (NEO), OmiseGo (OMG), Ark (ARK), Lisk (LSK), and Waves (WAVES).

Passive Method 6: Exchange Dividend Coins

Exchange dividend coins are similar to regular dividend coins but supported by an official exchange. They usually contain other perks, such as the ability to pay for various exchange fees using their official coins. Exchange dividend coins are also an effective way to raise money through crowdfunding.Tip: Here are examples of exchange dividend coins: Binance (BNB), Kucoin Shares (KCS), Huobi Token (HT), and BiBox (BIX).

Passive Method 7: Staking

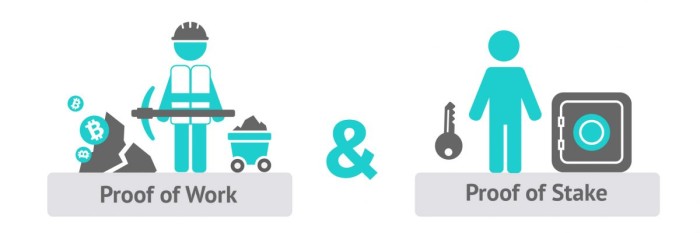

Figure 6: Proof of Work and Proof of Stake Illustration

Instead of Proof of Work (POW), also known as mining, you can do Proof of Stake (POS). POW relies on proof that a certain amount of work has been done to verify transactions and was the chosen way of the first cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. POS, on the other hand, only requires participants to hold a certain amount of native cryptocurrency in a specific wallet for a specified period. POS nodes are called "validators" instead of "miners." For POS, no specialized computer hardware is needed to become a node. POW nodes also tend to become centralized over time, while POS nodes tend to stay decentralized. Furthermore, POS is much more environmentally friendly because significantly less power is used to maintain the validator nodes.

Tip: Staking, POS, seems to be the future trend for the next generation of cryptocurrency coins because of a multitude of advantages. However, critics argue that POS might lead to centralized creation of the coins which the POW methodology prevents. Some coins are a combination of both POW and POS methodologies.

Passive Method 8: Masternodes

Masternodes are the highest form of staking with the corresponding highest payouts, but you need to buy much more of the coin. A Masternode is a full crypto node, a computer wallet, that supports the network by hosting an entire copy of the coin's ledger in real-time. It also allows the user to take part in governance and voting too. Furthermore, it enables the treasury and budgeting system in cryptocurrencies. However, a significant drawback is that Masternodes require running your node non-stop, similar to a mining rig.Tip: Here are sites for information on available Masternodes:https://masternodes.pro and https://masternodes.online.

Passive Method 9: Hard Forks

Figure 7: Soft Forks versus Hard Forks

A soft fork is a backward compatible method of upgrading a blockchain. On the other hand, a hard fork creates a new permanent divergence from the previous version of a blockchain. Hard forks are needed to add new functionality to existing cryptocurrency. They are a great way to earn free crypto! From time to time, there are hard forks such as when Bitcoin Cash (BCH) was developed from Bitcoin (BTC) or when Ethereum classic (ETC) diverged from Ethereum (ETH).

Tip: You can get information about an upcoming hard fork from an insider group or blog. A few days before the expected hard fork, buy a lot of the original coin. After the fork date, you will get the same amount of the new cryptocurrency coin!

Passive Method 10: Trading Bots

Trading bots or Algo trading or auto trading is not a new way to trade. Institutions have been using trading bots for decades, but it is only recently that they have been made available to the broad public. Trading bots use algorithms that are programmed to take trades on behalf of the trader. They use various market actions to determine their entry and exit points based on such metrics as price, time, order, volume, etc. Trading bots can also be set up to handle multiple exchanges simultaneously. Thus market arbitrage is possible. The price to use trading bot varies; some have a one-time fee, while others use a pay-per-use or subscription-based model.Tip: Trading bots can be a great tool to use. They can save you a tremendous amount of time, especially if you are an experienced trader, though they are quite technical to set up and require some necessary programming-related skills for advanced features, so take baby steps in using them!

Recommendations:

Shrimpy is an excellent platform to use that allows you to manage your crypto assets stored on different exchanges automatically.

Holiday Sale: 50% Off on all our digital products! https://www.moneywisealpha.com/product-category/digital/?orderby=price

Join our mailing list to get a 1-Page Quick Guide on “How To Earn Crypto For Free!” https://moneywisealpha.com/mailinglist

EOS (Earn $50 in EOS): https://www.moneywisealpha.com/recommends/eos

Stellar (Earn $50 in XLM): https://www.moneywisealpha.com/recommends/xlm

Follow Us On Social Media:

Website: http://www.moneywisealpha.com/

Book Site: http://btcmoneytop20.com

Facebook Book Page: https://fb.me/BTCMoneyTop20Ways

Blog Site 1: https://medium.com/money-wise-alpha

Blog Site 2: https://www.publish0x.com/money-wise-alpha/

Blog Site 3: https://steemit.com/@moneywisealpha

Blog Site 4: https://moneywisealpha.tumblr.com/

Blog Site 5: https://moneywisealpha.blogspot.com/

Facebook Book Page: https://fb.me/BTCMoneyTop20Ways

YouTube: https://youtube.com/c/MoneyWiseAlpha

DailyMotion: https://www.moneywisealpha.com/dailymotion

DTube: https://www.moneywisealpha.com/dtube

Bitchute: https://www.moneywisealpha.com/bitchute

Book Promotion: https://www.youtube.com/watch?v=EQnmcY_VfME

Twitter: https://twitter.com/my_csales23

LinkedIn: https://www.linkedin.com/in/christian-john-sales-92375ab/

Book Group: https://www.linkedin.com/groups/10472552/

Telegram: https://t.me/MoneyWiseAlpha

No comments:

Post a Comment